With the departure of Mint, users are left wondering about alternative budgeting solutions. YNAB emerges as a formidable option, renowned for its proactive approach to financial management. But is it the right choice for you? Check out the post to know if mint is gone should I try ynab?

Evaluating Your Needs

Assess your budgeting requirements and preferences. Consider factors such as automation versus manual tracking, goal-oriented budgeting, and the level of financial awareness desired.

YNAB: A Paradigm Shift

Transitioning to YNAB represents more than just switching platforms—it entails embracing a different mindset. YNAB’s philosophy revolves around giving every dollar a job, encouraging users to be intentional with their spending.

Active Engagement vs. Passive Tracking

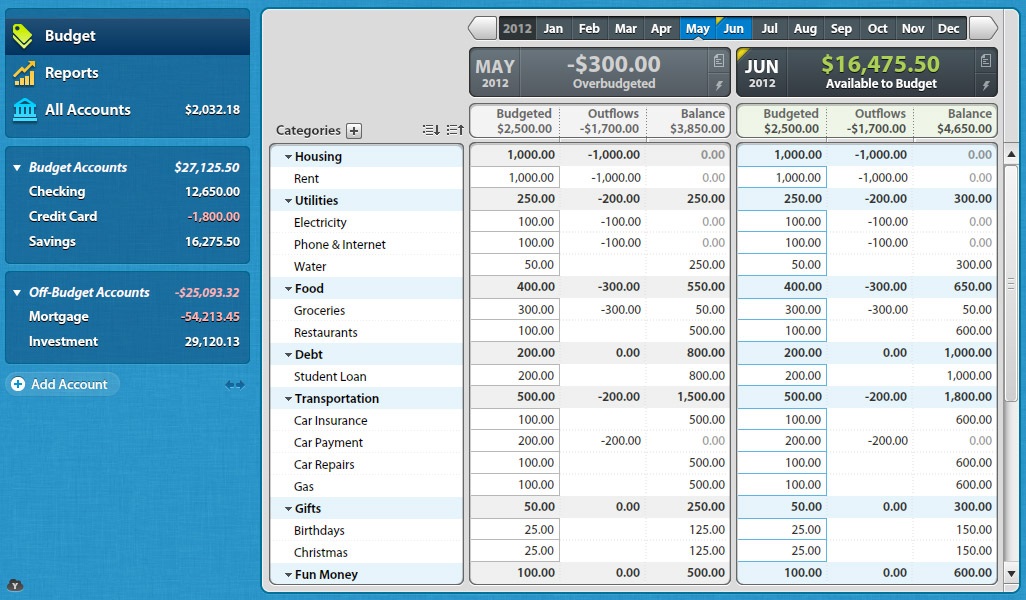

YNAB emphasizes active engagement, requiring users to allocate funds manually to budget categories. In contrast, Mint offered passive tracking, automating transaction categorization based on predefined rules.

Embracing Financial Accountability

YNAB fosters financial accountability by necessitating user involvement in the budgeting process. This hands-on approach promotes a deeper understanding of spending habits and cultivates responsible financial behavior.

YNAB’s Learning Curve

Transitioning to YNAB may entail a learning curve, particularly for users accustomed to Mint’s automation. However, YNAB’s resources, including tutorials and support, facilitate a smooth transition.

Features Comparison

YNAB’s Proactive Budgeting Tools

YNAB offers robust budgeting tools geared toward proactive financial planning. From goal setting to debt payoff strategies, YNAB empowers users to take control of their finances actively.

Personalized Financial Goals

YNAB enables users to set personalized financial goals and track progress toward achievement. Whether saving for a vacation or paying off debt, YNAB provides the tools necessary to stay on track.

Security and Privacy

Similar to Mint, YNAB prioritizes the security and privacy of user data. With bank-level encryption and regular security audits, users can trust YNAB to safeguard their sensitive financial information.

Should You Make the Switch?

Ultimately, the decision to transition to YNAB depends on your budgeting preferences and goals. If you value active engagement, proactive financial planning, and personalized goal-setting, YNAB may be the ideal solution for your budgeting needs.

Conclusion

In the wake of Mint’s departure, exploring alternative budgeting platforms becomes imperative. YNAB stands out as a compelling option, offering a proactive approach to financial management and robust budgeting tools. Consider evaluating your budgeting requirements and preferences to determine if YNAB aligns with your financial goals. As the post-Mint era dawns, embracing new budgeting methodologies may pave the way toward financial empowerment and success.

Transitioning to YNAB may entail a learning curve, particularly for users accustomed to Mint’s automation. However, YNAB’s resources, including tutorials, support forums, and personalized assistance, facilitate a smooth transition and empower users to harness the platform’s full potential.